Asia Stocks to Drop; U.S. Shares Sink, Bonds Rally: Markets Wrap

Asian stocks look set to fall Thursday after a sharp reversal in U.S. shares on concerns about risks from the omicron strain and as Jerome Powell reiterated a pivot toward potentially tapering stimulus more quickly.

Australian equities dropped and futures for Japan and Hong Kong pointed lower, while U.S. contracts edged up. The S&P 500 posted its worst two-day selloff since October 2020 after erasing a near-2% rally to slide into the close. The technology-heavy Nasdaq 100 underperformed.

Markets were jolted by the first confirmed U.S. case of the new variant, whose emergence has brought fresh challenges for economic reopening. At the same time, Federal Reserve Chair Powell reiterated officials should consider a quicker reduction of monetary stimulus amid elevated inflation.

The 30-year Treasury yield fell to its lowest level since January. Risk aversion bolstered the dollar. An index of Chinese shares traded in the U.S. slid as Beijing’s plan to close a loophole tech firms use to list abroad hit sentiment.

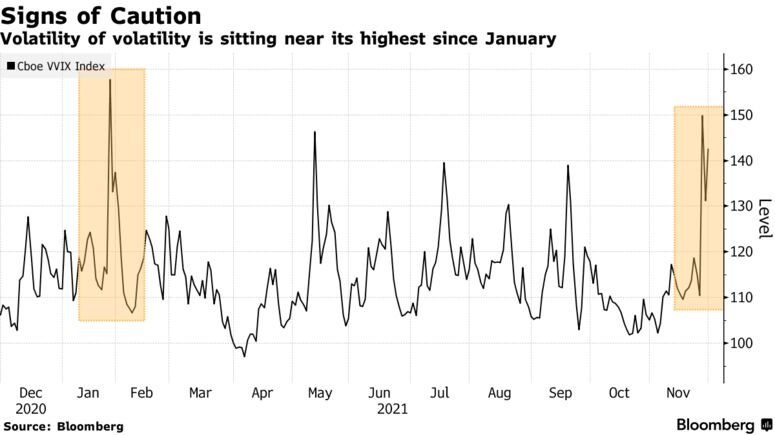

Investors are braced for volatility in financial markets to continue through December, stirred by tightening central bank policies to fight inflation just as the omicron variant threatens to impede the pandemic recovery.

“The omicron variant is the number one uncertainty facing the U.S. economic outlook,” Kim Mundy, a strategist at the Commonwealth Bank of Australia, wrote in a note.

The U.S. economy grew at a modest to moderate pace through mid-November, while price hikes were widespread amid supply-chain disruptions and labor shortages, the Fed said in its Beige Book survey.

On the Covid front, South Africa said its cases almost doubled from Tuesday. The new strain emerged in the U.K., Switzerland and Brazil. The World Health Organization’s chief scientist noted vaccines will likely protect against severe cases of the variant. Many questions about the strain remain unanswered.

Crude oil advanced as traders await an OPEC+ meeting that will discuss output. Elsewhere, gold rebounded and Bitcoin traded at about $57,160.

© 2021 LeackStat.com