GameStop: Were The Short Sellers Routed? Does It Matter?

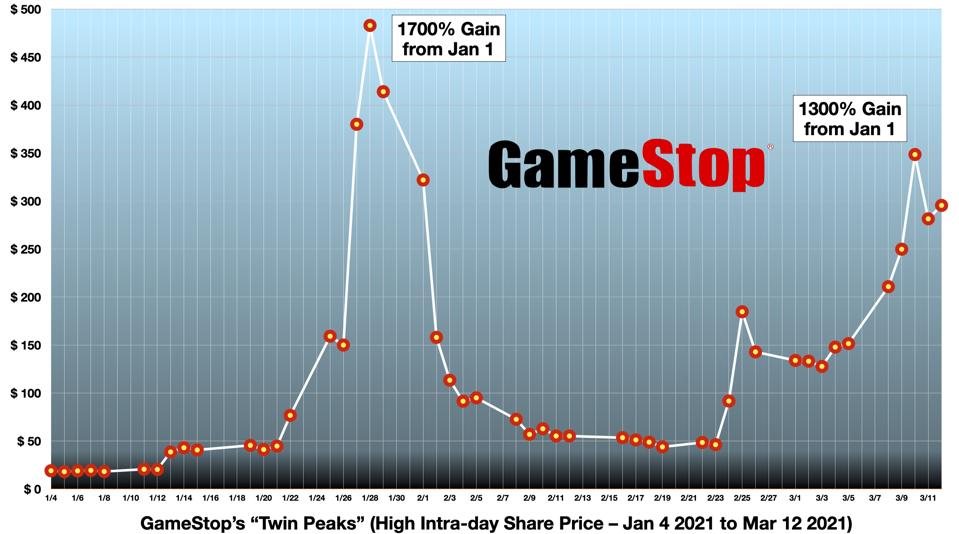

The “twin peaks” pattern in GME’s share price (January and February/March) has shocked the markets.

GME's Twin Peaks - The January and February Surges CHART BY George Calhoun

There is no obvious fundamental driver for a 1700% gain in the GME share price in less than a month. GME’s sales have contracted by 30% in the past two years, with losses of over $1 billion. Bloomberg columnist Matt Levine summed up the company as “a money-losing mall retailer in a dying business during a pandemic.” Maybe the future will be brighter, or maybe not. But it is clear that right now Price and Value are out of joint.

Beyond that, however, the pattern make no sense technically, at least according to the standard view of how the market works and how prices move. Normally, when a stock moves up, we expect a certain steadiness. There are mechanisms – psychological, procedural – that guide-rail the process. A triggering event catches the market’s attention and prompts a reassessment. Some investors move quickly; others lag, then join in. Momentum develops, trend-followers pile on, the media talk up the story, the chat rooms get going, and investor sentiment ripens to a golden glow of positivity. The equilibrium-seeking tendencies of the market modulate price movements and smooth out the fluctuations.

© 2021 LeackStat.com