Nine Takeaways from Citi’s Deep Dive into Gen AI and Banking

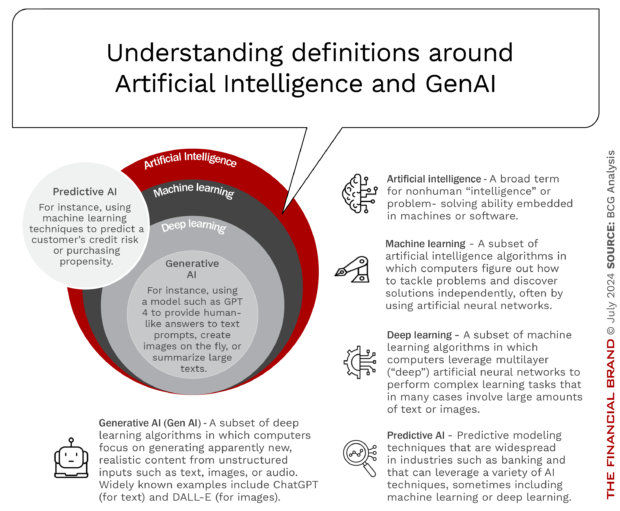

Artificial intelligence (AI) is transforming the landscape of retail banking, offering unprecedented opportunities for innovation, efficiency, and customer engagement. Banks, credit unions and fintech providers must understand the current applications and future potential of AI to stay competitive in an increasingly demanding and fractured financial ecosystem. New research from Citi provides a glimpse into current potential cases.

Artificial intelligence is not new to the banking industry. For more than a decade, banks have been leveraging AI in fraud detection, credit scoring, and more recently, customer service through chatbots and virtual assistants. These applications improve operational efficiency and enhance the overall banking experience for customers and members.

Yet, with the introduction of generative AI and the accelerated pace of use case development, financial services leaders are looking to revolutionize further product development, risk management, customer experiences, internal efficiencies, and strategic decision-making processes to become future-ready and resilient.

As we review AI in retail banking, it’s essential to consider both the opportunities and challenges of these technologies. While AI promises increased productivity, customer experiences, and cost savings, it also raises questions about data use and privacy, ethics, and the balance of human and digital in the delivery of banking services.

Balancing the opportunities and challenges will be critical as banks navigate the AI revolution and seek to leverage their full potential to drive and maintain a competitive edge in the evolving financial services ecosystem.

The AI Opportunity

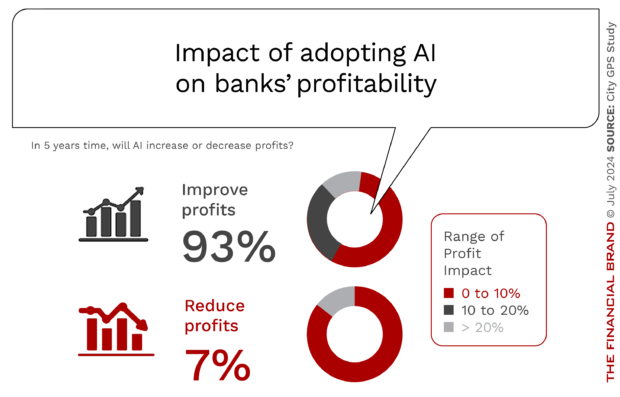

The financial services industry is at an inflection point with AI. A recent study by Citibank found that 93% of financial institutions expect AI to improve profits over the next five years. Applying these survey results to forecasts, Citi estimates that AI could boost banking industry profits by 9%, or $170 billion, by 2028.

The profit boost will be primarily from productivity gains, as AI helps automate routine tasks and augment human capabilities. The study notes that “nearly two-thirds of all work done in banking and insurance has a high potential for AI-driven automation or augmentation.” This is higher than what has been projected for most other industries.

AI-Powered Interactions

One of the most talked-about applications of AI in retail banking is improving customer experiences. AI-powered chatbots and virtual assistants are already increasingly sophisticated, capable of handling complex queries and providing personalized financial advice proactively … using the communication channel of choice.

AI-powered assistants can provide 24/7 availability, instant responses, and personalized service at speed and scale. OpenText says AI-powered chatbots can handle up to 80% of routine customer service questions, freeing human agents to focus on more complex issues. This improves efficiency and enhances customer satisfaction by quickly and accurately responding to inquiries.

Personalization at Scale

AI enables retail banks and credit unions to offer hyper-personalized services and predictive product recommendations based on internal and external customer data, behavior patterns, and financial need assessment. This level of personalization was previously impossible at scale but is now becoming a reality thanks to AI and machine learning algorithms.

Creating personalized customer experiences is more important than ever, as non-traditional financial services organizations offer more specialized services based on preferences, financial goals, and risk profiles. Beyond causing ‘silent attrition’ from legacy banking organizations, these non-traditional players are realizing higher cross-sell rates and are creating loyalty through higher levels of engagement.

The good news is that legacy financial institutions also have access to these AI tools — and a deeper understanding of existing customers. The Citi GPS report suggests that AI-enabled personalization could help traditional banks provide more tailored offerings and improve customer engagement.

Financial Advice

As AI becomes more sophisticated, there will likely be a rise in AI-powered financial advisors and even the use of ‘digital twins’ that can bridge the gap by providing personalized financial guidance to retail banking customers. AI-powered advisors could analyze a customer’s economic situation, goals, and risk tolerance to provide tailored advice on savings, investments, and financial planning more unbiasedly and immediately than currently deployed.

The Citi GPS report hints at this future, suggesting that “by 2030 or earlier, AI agents could be making financial decisions and interacting with banks on behalf of consumers.” While this level of AI autonomy may still be some years away and may be met with some level of skepticism by consumers, we’re likely to see increasing integration of AI into financial advisory services in the near term.

Product Development and Marketing

As referenced, AI-powered predictive analytics can enable retail banks to anticipate customer needs. This insight can help financial institutions develop products that better meet those needs. Unlike in the past, when every financial institution had the same menu of deposit, loan, and payment products, AI can now analyze vast amounts of customer data and market conditions to create hyper-personalized services at scale and highly targeted marketing strategies to promote these services.

More importantly, AI can help banks forecast customer behavior, identify potential churn risks, and suggest product offerings that could reverse damaging attrition. The Citi report suggests that AI could drive “productivity gains for banks by automating routine tasks, streamlining operations, and freeing up employees to focus on higher value activities.” This includes product development and targeted marketing, which can directly impact a bank’s bottom line.

Financial Inclusion

While not covered as extensively in the report, AI has the potential to expand access to financial services for underserved populations by including alternative data sources and advanced risk assessment models. By including the universe of consumers and businesses with ‘thin files,’ banks could extend credit and other financial services to those previously excluded by traditional banking models. This is already being achieved by many fintech and big tech firms.

The Citi GPS report states that AI-powered credit risk assessment models can be customized to specific customer segments, potentially opening up new markets for retail banks. This could be particularly impactful for people who rent, have service jobs, receive cash payments for work, etc.

Credit Risk Assessment

While the origin of AI in banking was in risk and fraud monitoring, advanced algorithms are now analyzing vast datasets to evaluate creditworthiness faster and more accurately than ever before. The Citi GPS report notes, “AI-powered credit risk assessment models can now be customized to specific industries, customer segments or regions, capturing the needs/behaviors of different groups.”

This level of customization allows for more nuanced and accurate risk assessments. In addition, AI can now help banks continuously monitor borrower behavior against macroeconomic conditions, enabling real-time adjustments to risk profiles and loan-loss provisioning. This approach to risk management could significantly reduce defaults and improve the overall health of loan portfolios.

Fraud Protection

The need for robust fraud and cybersecurity capabilities has never been more critical. As adverse forces continually find new ways to impact security provisions negatively, AI is improving fraud detection and prevention in retail banking. Advanced fraud detection systems analyze vast amounts of data in real time, identifying suspicious patterns and anomalies that might indicate fraudulent activity. These systems learn from new fraud patterns and adapt detection algorithms accordingly to keep one step ahead of cybercriminals.

The Citi GPS report highlights how AI systems are dramatically improving the efficiency and effectiveness of transaction monitoring for fraud and money laundering. One area of improvement is reducing false positives with AI, allowing human analysts to focus on more complex cases requiring deeper investigation.

AI in the Back-Office

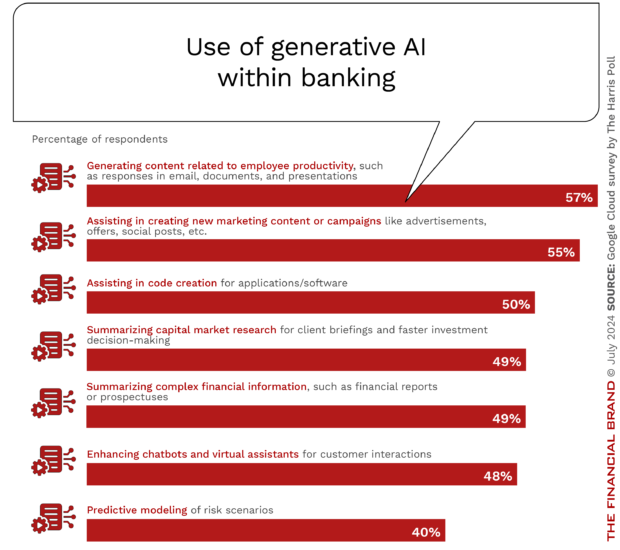

Despite the power of using AI to drive better customer experiences, develop new products, increase engagement, and expand the reach of banking, many of the current AI initiatives are focused on revolutionizing back-office operations. In other words, cost savings.

Robotic Process Automation (RPA) combined with AI can automate routine tasks, reduce errors, and free up human capital to focus on higher-value activities. AI is believed to automate up to 80% of routine work in banking, including data entry, report generation, and compliance checks.

This automation will also lead to significant cost savings and improved operational efficiency.

The Citi GPS report notes that “GenAI will likely have a big impact on internal facing tasks such as content and information management, coding, and software.” This suggests that AI could transform everything from document processing to software development within banks.

Regulatory Compliance

The regulatory landscape for banks often seems to be playing catch-up with artificial intelligence. That said, AI is proving to be a valuable tool in helping banks navigate the complexity of regulatory demands and ensure compliance across diverse regulations.

As with many other back-office functions, AI can help banks automate compliance processes, reducing human error risk and ensuring consistent application of regulatory requirements. AI also is nimble, with the ability to quickly adapt to new regulatory changes. According to the Citi GPS report, “compliance roles have tripled in the US from 2000 to 2023.”

Challenges with AI Implementation

While the potential benefits of AI in retail banking are significant, there are also challenges that banks must address:

- Data Privacy and Security: Since AI systems require access to vast amounts of customer data, privacy and security become critical. Banks must implement robust safeguards and comply with evolving data protection regulations.

- Ethical Concerns and Bias: Banks must ensure their AI systems are designed and trained to be fair and unbiased, avoiding unfair or discriminatory outcomes, particularly in areas like credit decisioning.

- Regulatory Compliance: Banks need to ensure their AI systems comply with existing regulations and be prepared to adapt to new rules as they emerge.

- Lack of Transparency: Banks must avoid advanced machine learning models that act like “black boxes” (where it’s difficult to understand how they arrive at decisions). Lack of transparency poses challenges to regulatory compliance and damages trust with customers.

- Skills Gap: Implementing and managing AI systems requires highly demanded specialized skills. Banks must invest heavily in training and recruitment to build necessary AI capabilities.

- Fear of the Unknown: Many employees and customers fear the unknown associated with AI. This includes all of the above challenges, as well as the fear of job displacement and the lack of human engagement. Ongoing communication with employees and customers regarding how AI will be used (and its impact) is essential.

Recommendations for Retail Banks

Based on industry research and research by the Digital Banking Report, here are key recommendations for retail banking organizations:

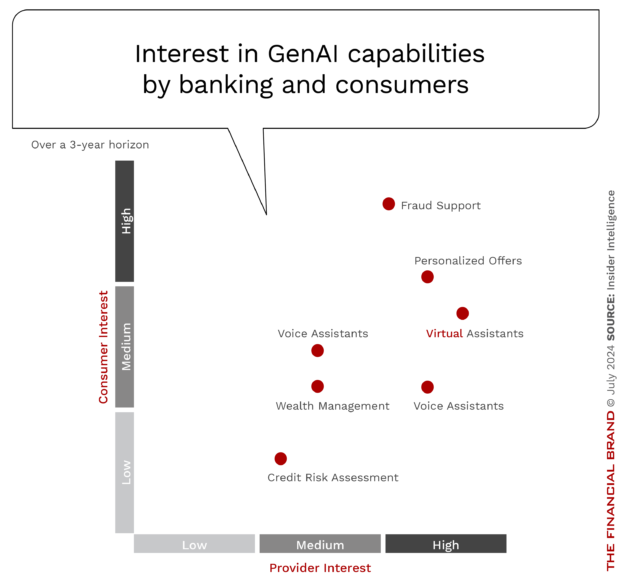

- Develop a Comprehensive AI Strategy: Rather than implementing AI in silos, banks must develop a clear and comprehensive strategy for integrating generative AI into the company’s operations, including implementation, governance, and risk management plans.

- Prioritize AI Investment: Invest in testing and evaluating different use cases for generative AI, such as fraud detection, virtual assistants, personalized offers, etc.

- Modernize Core Systems: Address legacy technology issues to create a flexible, AI-ready infrastructure.

- Focus on Customer-Centric AI Applications: AI use cases that directly enhance customer experience, engagement, and customer value, such as personalization, improved customer service, and streamlined processes, should be evaluated with potential ROI attached.

- Invest in AI Talent and Training: Build internal AI capabilities through hiring and upskilling programs. Also, familiarize stakeholders with generative AI and its effects on banking.

- Build Trust Through Transparency: Be open with customers about how AI is used in banking services. Provide clear explanations and options for human interaction where needed.

- Prepare for AI-Powered Customers: Start considering how banking models might need to evolve in a world where AI agents act on behalf of customers.

- Collaborate and Partner: To accelerate AI adoption and innovation, consider partnering with fintech companies, third-party technology providers, and even other banks.

- Monitor and Adapt: Continuously monitor technological developments, competitive moves, and regulatory changes … being prepared to adapt strategies quickly.

Catching Up and Moving Forward

As the financial services industry evolves, retail banks must prioritize catching up with the rapid advancements in AI technology. The potential benefits of AI are too significant to ignore, and banks that fail to adapt risk falling behind their more innovative competitors. That said, any commitment to investment in AI must consider other technology priorities that are relatively speaking … ‘low-hanging fruit.’

Moving forward, retail banks must build a strong foundation for AI adoption to move forward. This includes investing in the necessary technology infrastructure, developing a comprehensive AI strategy, and engaging employees and customers regarding how AI will be implemented. By doing so, banks can position themselves to take full advantage of AI’s opportunities.

Unfortunately, many banks are still slow in adopting AI. Nearly a quarter of banks have ‘not started’ on AI adoption yet. In contrast, this number is significantly lower for fintech firms and insurance companies—at just about 5%. Furthermore, 68% of respondent banks are still only in the ‘beginning’ stages of their AI journey, compared to more than 80% for other financial sectors.

In conclusion, AI represents a transformative opportunity for retail banking, potentially significantly enhancing customer experiences, improving operational efficiency, and driving profitability. The time to act is now because catching up gets more difficult (and costly) every day.

LeackStat 2024