Oil Slumps With OPEC+ and Ukraine Headlines Sparking Huge Swings

Crude futures sank as the United Arab Emirates called on OPEC+ to boost oil output faster while Ukrainian President Volodymyr Zelenskiy reiterated willingness to consider some compromises to end the war with Russia.

Brent dropped more than 17%, falling to nearly $105 a barrel, after a confluence of headlines sparked a risk-off sentiment throughout markets. The UAE said it will call on its fellow OPEC+ members to boost oil output faster. At the same time, Zelenskiy reiterated to Germany’s Bild newspaper it was ready to make compromises to end the war.

“The market has not lost an overwhelming amount of oil just yet, its pricing a risk premium that the amount of oil lost is going to be significant and force demand destruction,” said Scott Shelton, energy specialist at ICAP North America Inc. “As long as diplomacy wins out in the next few weeks, I think its safe to say prices should come down more.

Similarly, Iraqi Oil Minister Ihsan Abdul Jabbar Ismaael said from an oil conference in Houston that the country hasn’t seen extra demand from oil customers. There’s no need for OPEC+ to ramp up production more than planned, and additional hikes could harm the market, he added.

Russia is a major supplier of refined products to Europe and the threat of fuel supplies drying up in the region has sent diesel markets into a frenzy. U.S. distillates inventories fell to the lowest level since November 2014, dropping 5.23 million barrels, according to government data.

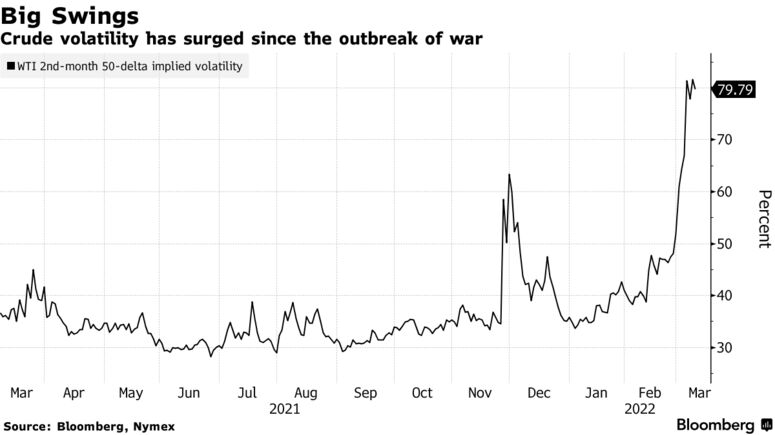

Volatility for WTI futures dropped more than six percentage points, the biggest decline since early December, potentially signaling some reduced geopolitical risk in the market.

The U.S. and U.K. decided Tuesday to halt Russian oil imports after Shell Plc and BP Plc said they are stopping new purchases, but other European nations have been reluctant to commit to similar action. The International Energy Agency said a recently announced stockpile release will amount to almost 63 million barrels of crude and products, but it has done little to cool prices.

Against the market’s fast-moving backdrop, OPEC+ is sitting on the sidelines sticking to its 400,000 barrel-a-day production increase. Russia is one of the key leaders of the cartel, along with Saudi Arabia and a major producer of crude and petroleum products such as diesel.

Oil imports from Russia made up about 3% of all the crude shipments that arrived in the U.S. last year. When other petroleum products are included, such as unfinished fuel oil, Russia accounted for about 8% of oil imports. A planned House vote on the legislation to ban imports was delayed, even as Biden moved ahead with executive action amid growing political pressure to do so.

“The market is awaiting the domino effect of mainland Europe announcing a ban, however, with oil majors announcing that they won’t touch Russian oil, there is already a de-facto ban,”said Keshav Lohiya, founder of consultant Oilytics.

Shell and BP said they won’t make any new purchases of Russian oil and gas, but they can’t immediately disentangle themselves from the country in part due to long-term contracts. It’s a dramatic U-turn for Shell, which faced heavy criticism for its purchase of Russian crude last week, and could have a huge impact on the region’s oil refining.

© 2022 LeackStat.com