Stock Rout Deepens on Earnings Doubts; Bonds Rally: Markets Wrap

A global stocks rout deepened on Thursday, with European shares tumbling and American index futures signaling more losses ahead after yesterday’s selloff that erased of $1.5 trillion of market value from US equities.

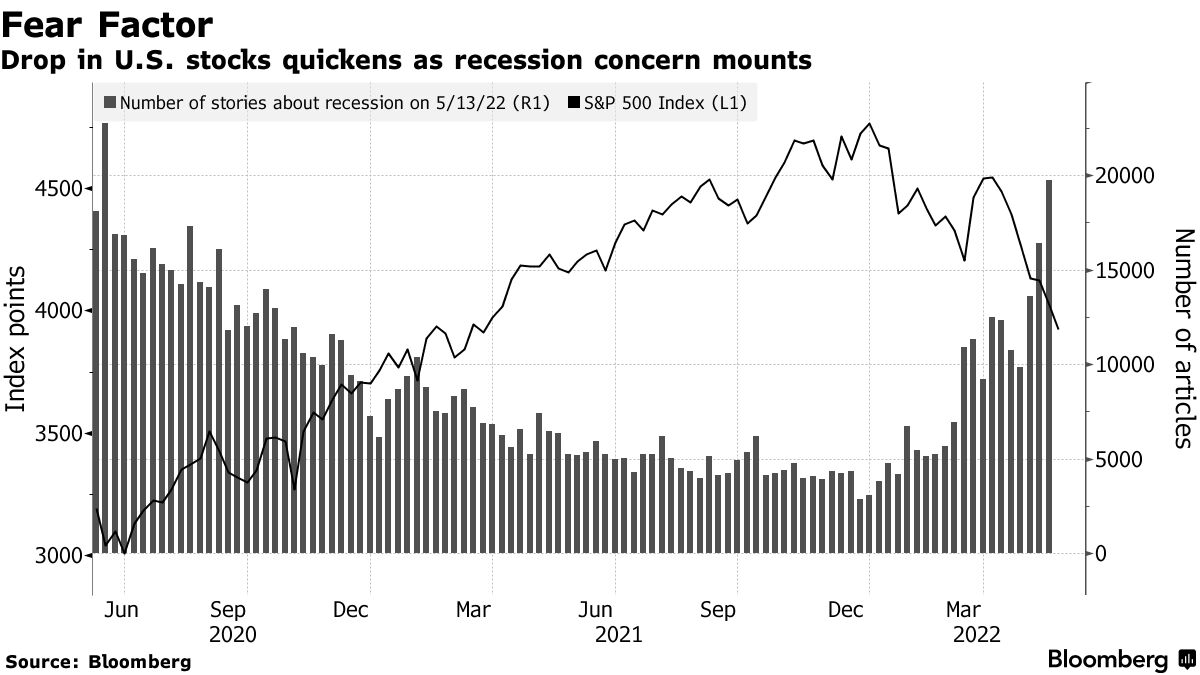

Futures on the S&P 500 Index slid 1.4% after the equity benchmark posted the biggest single-day drop since June 2020 on Wednesday amid growing concern that high inflation is cutting into corporate performance. Nasdaq 100 contracts were down more than 1.5% as a global selloff of technology stocks gathered momentum. The Stoxx 600 retreated more than 2%, with all industry sectors in the red and personal care and financial services leading the decline.

Treasury yields dropped about seven basis points as investors sought insurance against further declines in risk assets, with the Federal Reserve set on taming inflation via rate hikes and a shrinking balance sheet beginning in June. Most European bonds also gained, with the yield on German 10-year securities falling more than basis points. The dollar weakened against a basket of peers while the yen strengthened.

Bets that robust earnings can help investors weather this year’s turbulence were thrown in doubt after US consumer titans signaled growing impact of high inflation on margins and consumer spending. Meanwhile, Federal Reserve officials reaffirmed that tighter monetary policy lies ahead, and investors fretted over stagflation risks.

“We are pricing in a growth scare,” Lori Calvasina, the head of US equity strategy at RBC Capital Markets, told Bloomberg TV. “There is a lot of uncertainty in this market right now about whether or not that recession is going to come through or if it’s going to be another near-death experience.”

Stocks of retailers and consumer-discretionary companies posted some of the biggest losses in Asia and Europe after US investors questioned the lofty valuations of companies like Target Corp. against the backdrop of rising interest rates.

Tencent Slides

In China, Tencent Holdings Ltd. plunged 6.6% after warning it will take time for Beijing to act on promises to prop up the Chinese tech sector. Cisco Systems Inc. slid in extended US trading on a disappointing revenue outlook.

On the commodities front, crude oil extended declines, while most industrial metals were in the red as global growth fears damped the demand outlook. Copper held near a seven-month low and zinc extended losses.

Elsewhere, the Swiss franc extended its advance versus the dollar after Swiss National Bank President Thomas Jordan said policy makers are ready to act against inflation.

And in emerging markets, Sri Lanka fell into default for the first time in its history as the government struggles to halt an economic meltdown that prompted mass protests and a political crisis. An index of developing-nation stocks slumped more than 2%.

What damage will be done to the US economy and global markets before the Fed changes tack and eases policy again? The “Fed Put” is the theme of this week’s MLIV Pulse survey. Click here to participate anonymously.

© 2022 LeackStat.com