Stocks recover even as global recovery fears linger

European shares bounced back from their worst day of the year on Tuesday, but German bond yields slipped to fresh five-month lows as a reminder that investors remained worried the spread of the Delta coronavirus variant could derail the economic recovery.

Europe’s STOXX 600 added 1%, boosted by a clutch of positive corporate earnings and production updates from miners, while in the U.S. e-mini futures for the S&P 500 index were up 0.6%.

The positive moves followed more selling in Asia, with MSCI’s gauge of Asia Pacific stocks outside Japan falling 0.7% and Japan’s Nikkei 225 hitting a six-month low, down nearly 1%.

China deleveraging risks hurt property stocks and the broader market for a second day, causing a plunge in shares of heavily indebted developer China Evergrande Group. The Hang Seng Index dropped 0.8% while China’s blue chip CSI300 Index was 0.1% lower.

MSCI’s broadest gauge of global shares was 0.5% lower, extending its longest-losing streak in nearly 18 months.

“The reality is that this price action has become somewhat self-fulfilling as the myopic investor sentiment and positioning are forced to re-assess,” said James Athey, investment director at Aberdeen Standard Investments.

“I fear the equity selling isn’t over yet, and if I am right, Europe will be the worst place to be given the index is value dominated – and thus very cyclical.”

Riskier assets globally have come under pressure recently as many countries struggle to contain the outbreak of the fast-spreading Delta virus variant, raising fears that further lockdowns and other restrictions could upend the worldwide economic recovery.

Stocks on Wall Street fell as much as 2% on Monday, with the Dow posting its worst day in nine months as COVID-19 deaths increased in the United States.

In a separate gauge of investor risk appetite, bitcoin fell below $30,000 for the first time since June 22.

“Despite the vaccine rollout, markets do not appear to be learning to live with COVID-19,” ANZ analysts wrote in a note to clients.

"Sentiment appears to have shifted, at least for the moment, to a persuasion that growth and earnings expectations may be overdone,” they said, noting that risk-averse investors were bailing out of commodities.

In a sign of lingering fears of the spread of the Delta variant, the Aussie dollar/Swiss franc cross, a favourite proxy in currency markets for economic recovery bets, fell to its lowest level since December 2020 at 0.6714 francs, according to Refinitiv data.

Against a basket of its rivals, the U.S. dollar strengthened widely on Tuesday and was close to an early-April high of 93.041 hit in the previous session.

U.S. yields turned higher following Monday’s searing rally. The 10-year yield rose to 1.217% from a close of 1.181%, a level last seen in February.

However, while the U.S. yield curve steepened slightly, the spread between the U.S. 10-year and 2-year yield remained near February lows, signalling investor doubts about the growth outlook.

In Europe, Germany’s 10-year yield, the benchmark for the bloc, briefly fell to -0.403%, breaching a new lowest level since February and was down around 1 basis point to -0.398%, as of 0733 GMT.

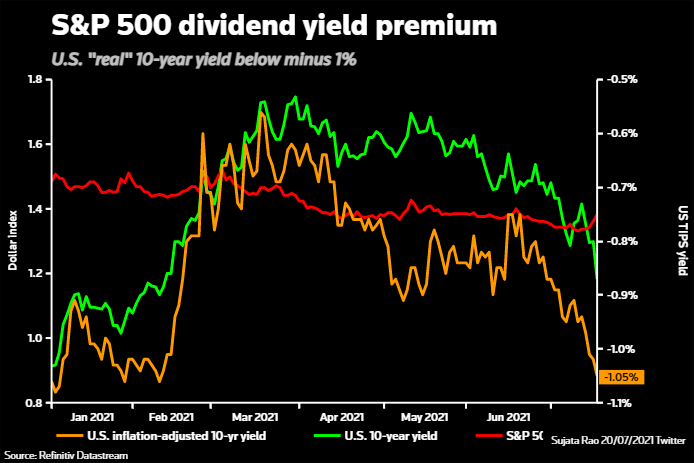

Graphic: Dividend yield vs bond yield -

Oil prices stabilised after slumping around 7% in the previous session due to worries about future demand and after an OPEC+ agreement to increase supply.

Brent crude gained 0.7% to $69.11 a barrel. The U.S. crude contract for August delivery, which expires later on Tuesday, was up 0.9% at $66.64 a barrel.

Spot gold was flat at $1,812.16 per ounce after hitting a one-week low of $1,794.06 in the previous session.

© 2021 LeackStat.com